2 min read

Top 3 Benefits of the Scoir Counselor Collective

The Scoir Counselor Collective was created for you—school counselors looking to strengthen their network and build community among each other. As...

Free for students & their families

Seamlessly integrated, affordable systems for use across your district.

Career Readiness for 6-8 grade, built to guide and track progress in the early years of career exploration.

Scoir + Common App are integrated for the 2025-26 academic year!

Check out content and practical guides to help inform your enrollment strategies and programs.

4 min read

Peter Van Buskirk

:

October 01, 2025

Peter Van Buskirk

:

October 01, 2025

Gaining admission to the college(s) of your choice might weigh heavily on your mind at the moment. The odds are that the prospect of affording college looms even larger, especially with some price-tags ranging above $70,000 per year. If financial aid is critical to your ability to attend such a college—or any college for that matter—the summer is the time to get organized around the possibilities.

If you're a a junior, you may be watching your senior friends go through the college application and financial aid process and wondering how you can take control of your college finances.

Or, maybe you're a parent or guardian of a senior wondering where to start and how to help your student put their best foot forward in finding a college that is the right fit, without breaking the bank.

We can help. Read on to learn about the following financial aid topics:

So, what is financial aid? It can be a lot of things, including scholarships, grants, student loans, parent loans, and campus work opportunities. Financial aid is made available to help make college attendance more affordable.

Most financial aid is reflective of demonstrated need or the differential between:

Some assistance is offered on the basis of merit, aka recognition of some performance criteria established by the institution.

If you're a parent/guardian, we recommend that guardians see this as a partnership with their young adult, and in doing so, having a frank conversation about what the family is able and/or willing to spend on education can help.

Research the sticker prices online, keeping in mind that total cost of attendance can be 15-20% higher than the published tuition, room and board.

It’s important to find colleges where your student will be valued. You can get a sense of this by looking at the profile of admitted students on admission pages online, visiting campuses, and subscribing to student newspapers on those campuses.

So why do colleges charge so much? College expenses typically include tuition, room, board, and other fees.

Room and board amounts reflect market prices for food, supplies, dorms, maintenance, and staffing. Prices vary by room type and meal plan. Some colleges provide additional amenities that can increase costs.

Tuition covers educational expenses including faculty salaries, instructional facilities, lab equipment, libraries, athletic facilities, and health services.

Other fees can include lab fees, transportation, insurance, and social costs.

While private colleges often draw on endowments, public universities are subsidized by state legislatures. In most cases, the prices charged by colleges reflect real costs—and if you can’t afford the full cost, need-based financial assistance is available (typically through the FAFSA).

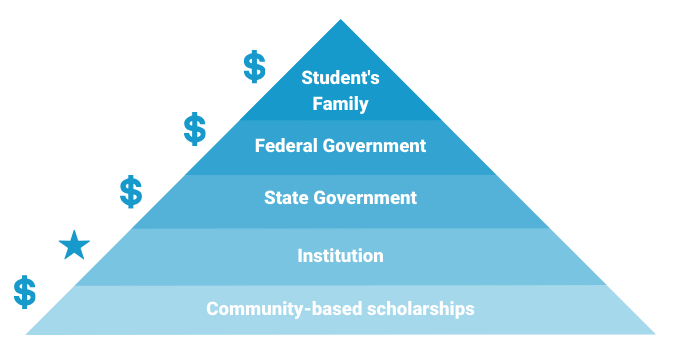

As you approach the financial aid process, it helps to think of financial aid officers as brokers. Their job is to maximize the revenue per student, considering five possible sources of funding:

While competitive, every funding source adds up—so explore them all. Ultimately, the process usually begins with family contributions and expands from there. This article on how to read a financial aid award letter goes into more detail about the sources of college funding and some other common financial aid terms.

The FAFSA is a government form that references IRS data to calculate your family’s need and determine eligibility for federal, state, and sometimes college aid. Starting with the 2024-25 FAFSA, the form includes:

This article outlines what you need to know about the FAFSA.

Seniors should complete the FAFSA as soon as possible before the deadline during your senior year, using IRS tax returns from two years prior. For example, students entering college in Fall 2027 will reference 2025 returns. Once completed, you’ll receive a summary with your SAI.

Typically, the FAFSA is available on October 1 every year.

Many private institutions require the CSS Profile in addition to the FAFSA. It provides a more detailed look at family finances and is customized by each college. Submit it as early as possible if required.

This article explains what you need to know about the CSS Profile.

Unlike the FAFSA, you won’t receive a report back—the results are sent directly to schools.

Similar to the FAFSA, the CSS Profile is usually available on October 1 every year. Check the deadlines for each college you're applying to, because they may vary.

Colleges attempt to determine your eligibility for financial aid via the Free Application for Federal Student Aid (FAFSA) or College Scholarship Service (CSS) Profile.

Whereas nearly every institution uses the FAFSA, only a few hundred colleges and universities use the CSS Profile, many of which are selective, private institutions.

Often, the CSS Profile will return a higher SAI for your family than the FAFSA. The bigger problem is that you do not receive anything back after completing the CSS Profile whereas the FAFSA delivers a Submission Summary to you revealing your SAI. So, many times, you will not know the resulting SAI from the CSS Profile until you actually get accepted to an individual college and receive a financial aid package.

For families to get an accurate sense of the real cost of attendance, they should plan to visit the university’s financial aid office during the summer before senior year (June-November).

If you are able to produce your most recent federal tax return, the financial aid officer should be able to do a calculation of your expected family contribution.

Most financial aid is based on need. If your SAI is less than a school’s cost of attendance, you’ve demonstrated need. But keep in mind that schools may calculate need differently, using their own methodologies or the CSS Profile.

Online forecasters and net price calculators rarely tell the full story. Colleges may use differential need analysis or preferential packaging, tailoring aid awards based on how much they value you as a student. Always ask questions, submit forms early, and seek transparency in the process. Make sure everyone is on the same page with regard to how much your family is able/willing to spend on a college education, and don't be afraid to appeal!

If you'd like to learn more about financial aid, watch this webinar recording: Financial Aid: Who Gets What and Why?

This article was originally published on October 13, 2021. It was updated on October 9, 2025 for accuracy and comprehensiveness.

A 25-year veteran of the college admission process, Peter Van Buskirk is dedicated to helping families find student-centered solutions in college planning. His ability to interpret and personalize a complex, and often mysterious, college-going process makes him a popular speaker among students, parents and educators. His creative programming has informed, inspired and entertained more than 2,000 audiences around the world. Peter’s books, Winning the College Admission Game; Strategies for Students and Parents and Prepare, Compete, Win! The Ultimate College Planning Workbook for Students, coach families through the complexities of finding and getting into the college that is the best fit for the student. His weekly blogs are featured on his website, www.BestCollegeFit.com, and he has appeared on numerous television and radio interviews including “Oprah and Friends” with Jean Chatzky. A graduate of Bucknell University, Peter moved through the ranks at Franklin & Marshall College to become Dean of Admission, Interim Director of Athletics, Associate Vice President for Enrollment Management, and Executive Officer in the Office of the Provost. He subsequently created and now operates Best College Fit® as a platform for delivering student-centered college planning content to students, parents and educators.

2 min read

The Scoir Counselor Collective was created for you—school counselors looking to strengthen their network and build community among each other. As...

4 min read

We recently published a podcast episode on this topic. This blog post provides a recap of what we covered during the episode. Hi! It’s Abby from...

6 min read

Gaining admission to the college(s) of your choice might weigh heavily on your mind at the moment. The odds are that the prospect of affording...